By: Bob Goldin | John Geocaris*

June 4, 2020

For the past five years, small and micro-sized food and beverage companies¹ have grown 2.5 times faster than larger companies². They have effectively capitalized on key consumer trends (such as simple and natural ingredients, better-for-you products, and snacking) and tapped into growing nontraditional channels, including online. As a result, these companies have gained valuable market share (especially in retail) and attracted attention from strategic and financial investors willing to pay lofty multiples for rapid growth in a stable but painfully slow growth industry. In addition, a number of large food and beverage companies like General Mills and Kraft Heinz created their own incubation arms to support the development of “upstart”/emerging companies.

For the past five years, small and micro-sized food and beverage companies¹ have grown 2.5 times faster than larger companies². They have effectively capitalized on key consumer trends (such as simple and natural ingredients, better-for-you products, and snacking) and tapped into growing nontraditional channels, including online. As a result, these companies have gained valuable market share (especially in retail) and attracted attention from strategic and financial investors willing to pay lofty multiples for rapid growth in a stable but painfully slow growth industry. In addition, a number of large food and beverage companies like General Mills and Kraft Heinz created their own incubation arms to support the development of “upstart”/emerging companies.

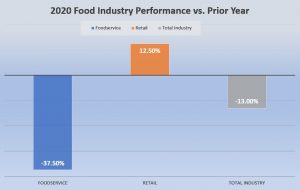

As we all are painfully aware, the pandemic has had a massive impact on the food industry. Due to stay at home and unit closure mandates, the foodservice industry has experienced a dramatic decline. We expect the recovery to be protracted and certain segments like independent restaurants, lodging and recreation are extremely unlikely to return to pre-pandemic volume levels for at least five years. While necessary, reopening mandates will exacerbate the “pain” the industry is suffering as they will limit on-premise capacity and add significant costs.

In contrast, retail has been booming as consumers shift a huge portion of their food and beverage expenditures (somewhat out of necessity) to at-home expenditures, and we project that retail will continue to benefit from the slow recovery of foodservice. The new market conditions will accelerate retailers’ initiatives to enhance their omnichannel effectiveness to meet consumer demands.

Given the fundamental shift in demand patterns coupled with what is almost certainly going to be an extended period of economic hardship, small companies will face many unexpected challenges that will limit their growth rates at least for the foreseeable future. Among these challenges are the following:

- In these troubled times, consumers will almost surely increase their reliance on “tried and true” brands and be less willing to experiment.

- Generally speaking, emerging company products are premium priced, and we foresee a significant migration to value tiers in a recessionary environment.

- Data suggest that consumer priorities are changing, with safety and security becoming far more important in the value equation. Arguably, this may minimize the appeal of many niche products/brands that are premised on other attributes such as sustainability, “fresh and natural” and the like.

- Major retailers and distributors are solidifying their market positions and will “double down” on their private label development initiatives, which have been successful prior to the recent public health crisis.

- As industry margin pressures intensify, participants will aggressively focus on structural cost reductions, with SKU rationalization a likely priority. Therefore, “slots”/shelf-space for relatively low volume SKUs will be reduced, to the detriment of many specialty/niche products.

- As early stage companies are often unprofitable, they rely on outside investment to fund their growth. While capital is available, we anticipate a shift in investor sentiment toward other more promising opportunities, including small food companies that are both profitable and have a demonstrated growth strategy. This could limit the ability of most unprofitable, high growth micro-sized food companies to raise needed funds.

While we believe that truly innovative small companies will continue to flourish, to do so will require even greater differentiation, an optimized supply chain, alignment with “winning” segments/customers, an intense consumer focus, and a business plan designed to reach profitability as quickly as possible.

A new, post Covid-19 growth strategy for emerging brands should contain some of the following elements:

- An initial regional expansion strategy focused opportunistically on all channels with the dual objective of proving the concept in the targeted channel and generating sufficient volume to become immediately profitable. An example would be taking on a large foodservice customer to build volume and attain breakeven operations while simultaneously exploring retail sales as the long-range strategic focus of the company.

- Manage the company for the long-term without an orientation toward a “liquidity event.”

- In-depth knowledge of production costs and how they change with volume. This will be true whether the product is co-packed or self-manufactured and will help in understanding when the emerging company will break even.

- When a firm foundation of volume/profitability is reached, a new growth strategy can be created, focusing on the long-term channel(s) for the product with outside capital if desired. This would be part of a deliberate strategy of maintaining profitability along with growth.

The need for emerging food and beverage companies to prioritize profitability vs. top-line growth represents a “sea change”. This path will enable these firms to establish sustainable positions and desirable outcomes.

¹We are defining a small company as having sales of $25 – 100 million and a micro company as having sales less than $25 million.

²Source: IRI and Boston Consulting Group’s 2019 CPG Growth Leaders report.

*John Geocaris is President of New Food Strategies, an emerging business advisory firm

.