by: Barry Friends | Bob Goldin

May 15, 2017

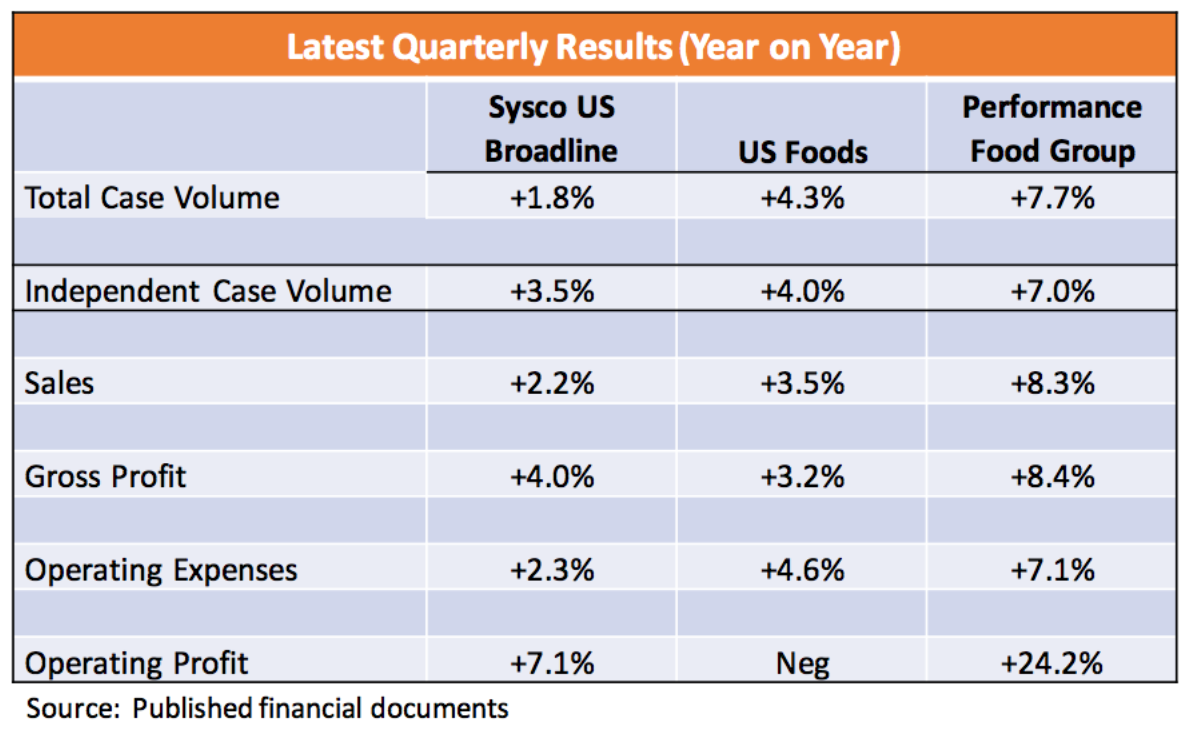

In the past few weeks, the three largest U.S. foodservice distributors – Sysco, US Foods, and Performance Food Group – all released their quarterly results. There is a lot to be gleaned from the numbers considering the three’s combined broad and deep market penetration.

In the past few weeks, the three largest U.S. foodservice distributors – Sysco, US Foods, and Performance Food Group – all released their quarterly results. There is a lot to be gleaned from the numbers considering the three’s combined broad and deep market penetration.

- All three companies are showing solid total case volume growth, ranging from Sysco’s +1.8% to Performance Food Group’s +7.7%. Given the size and diversity of their customer bases, this growth is a highly reliable indicator of end market trends.

- The impressive growth in each company’s independent case volume is a strong sign that the “street” business is healthy. It also reflects the fact that independents are significantly outperforming chains, which Pentallect estimates are experiencing case volume declines.

- According to Bureau of Labor Statistics, foodservice employment is +3.5% in the past year, a net addition of 320,000 jobs. This confirms the reasonably robust industry conditions indicated by the Big 3’s results.

- It also appears that these major distributors are gaining share in the strategically important independent market segment as each company’s independent case volume growth is meaningfully greater than the total independent market (Pentallect estimates independent case volume growth is 2.0-3.0%). To extrapolate fairly, one should note the combined “independent case” volume of US and PFG is less than Sysco’s share.

- US Foods and Performance Food Group have made several recent acquisitions of specialty and local market broadline distributors targeted at enhancing their position with independents. We expect this activity to continue, particularly by these two companies.

- Food cost inflation (as measured by the difference between sales and total case volume) is still virtually non-existent; this depresses sales dollar growth (but is a godsend to operator customers). Earnings leverage will certainly improve when food cost inflation inevitably resumes. Note: PFG’s positive 60 bps sales dollar vs. case growth rate likely reflects the recent addition of Red Lobster’s high-value SKU mix.

- The subject distributors are demonstrating focus on operating expense management.

We are impressed with the solid and balanced performance of these top-tier companies. They are focused and executing well under challenging market conditions. We commend their success.