By: Bob Goldin | Barry Friends

May 14, 2019

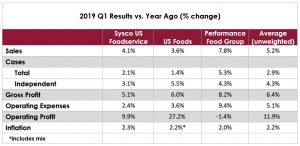

Against the backdrop of sluggish foodservice industry performance, rising labor and freight costs and a brutally cold winter in many parts of the country, the Big 3 publicly traded distributors (Sysco, US Foods and Performance Food Group) achieved impressive top- and bottom-line domestic results during the first quarter of this year. Their results clearly indicate that they are leveraging their scale, executional excellence and strategic clarity to gain valuable market share, most likely at the expense of small and mid-sized broadliners (many of which remain attractive “tuck-in” acquisition targets for the Big 3).

In their public releases, the referenced distributors noted major cost pressures. We expect these cost “headwinds” to persist and possibly accelerate as the labor market remains extremely tight and continues to fuel wage inflation. Sysco and US Foods have done a particularly impressive job controlling operating expenses – gross profit growth for both of these companies is well ahead of operating expense growth. This provides major earnings leverage. Additional earnings leverage is being gained by effectively managing the mix of low margin/high volume contract/chain vs. high margin/low volume street business.

Despite an apparent slowdown in growth of the independent market, the Big 3 continue to achieve eye-popping case volume growth in this important segment, ranging from 3.1% at Sysco (including recent acquisitions) to 5.5% at US Foods (100% organic). And the growth of their private brands continues, which is another important profit driver.

During the most recent quarter, Performance Food Group acquired Eby-Brown, a major convenience store distributor, and Sysco acquired two California-based Hispanic specialist distributors (in addition to Waugh Foods, a small broadliner in Illinois). This indicates that the Big 3 will continue to expand their portfolio by acquiring niche/specialty distributors and growing their “non-traditional” segment businesses, as Performance Food Group has done so masterfully with Vistar.